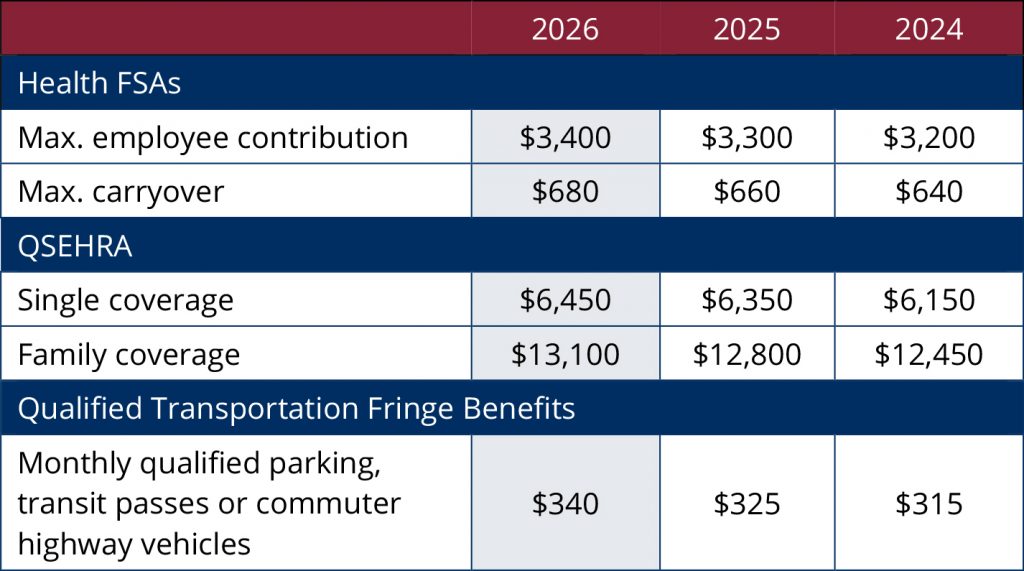

The IRS has announced 2026 cost-of-living adjustments for health flexible spending accounts (FSAs) and other tax provisions related to consumer-driven plans. The maximum voluntary employee salary reduction contribution to a health FSA gets a $100 bump, consistent with the past two years (see table).

Similarly, maximum reimbursements from a qualified small employer* health reimbursement arrangement (QSEHRA) and monthly limits on fringe benefit exclusions for qualified transportation also saw modest increases.

Health FSA maximums also apply to limited-purpose FSAs for dental and vision care services, tied to a health savings account (HSA).

MedBen clients with questions regarding these adjustments are welcome to contact Director of Administration Sharon A. Mills at (800) 423-3151, Ext. 438 or smills@medben.com.

* A “small employer” is defined as having fewer than 50 full-time employees.