An extensive investigation by Hunterbrook Media sheds new light on how the nation’s three largest PBMs may be using little-known affiliated entities – effectively middlemen to the middlemen — to quietly retain billions of dollars that employers and health plans never see.

According to the report, each PBM’s parent company created a separate organization it labels a “group purchasing organization,” or GPO — a term traditionally used for independent purchasing cooperatives — including Zinc (CVS/Caremark), Emisar (UnitedHealth/Optum), and Ascent (Cigna/Express Scripts). Because many PBM contracts only require pass-through of rebates received by the PBM itself, money routed through these affiliated GPOs can fall outside disclosure requirements — even though it ultimately benefits the same conglomerates.

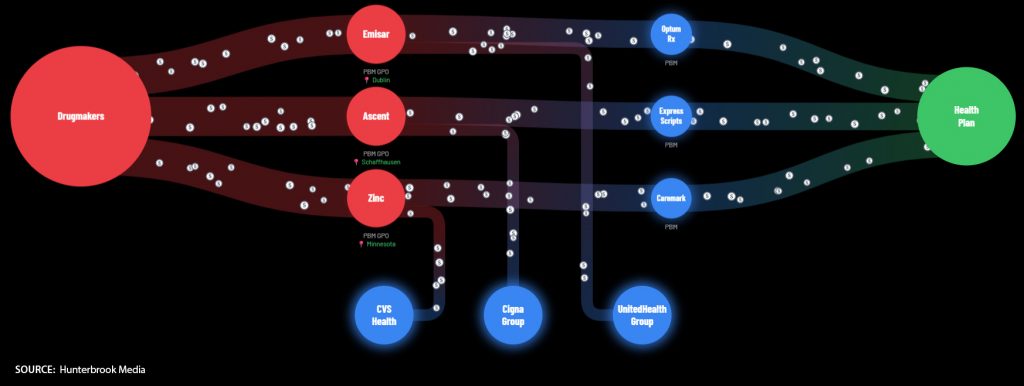

The chart below illustrates this flow. Drugmakers pay rebates and fees tied to formulary placement. PBMs pass along the rebates they directly receive, but affiliated GPOs retain separate manufacturer fees that may never be disclosed to employers or health plans, despite being negotiated on their behalf.

Regulators and attorneys general are increasingly scrutinizing these arrangements. Illinois recovered $45 million from CVS Caremark related to Zinc, and federal audits forced Express Scripts and Ascent to return tens of millions to public employee plans — signaling that PBM GPO practices are drawing serious legal and regulatory attention.

For employers, the takeaway is simple: receiving “100% of rebates” does not necessarily mean receiving all the value generated within the pharmacy supply chain.

The Hunterbrook investigation is lengthy, but for those who want a deeper understanding of why pharmacy costs remain high, it is well worth the read.